Editors Note: Smart Women Smart Money Magazine wants to highlight industry professionals who excel in their field. Our hope is to connect our readers with professionals who can help them in their financial journey. We also aim to inspire women to consider professions that support financial literacy efforts for individuals and their families. This is the sixth and final advisor in the spotlight.

What advice would you give young women just starting their careers who are considering the financial advising profession?

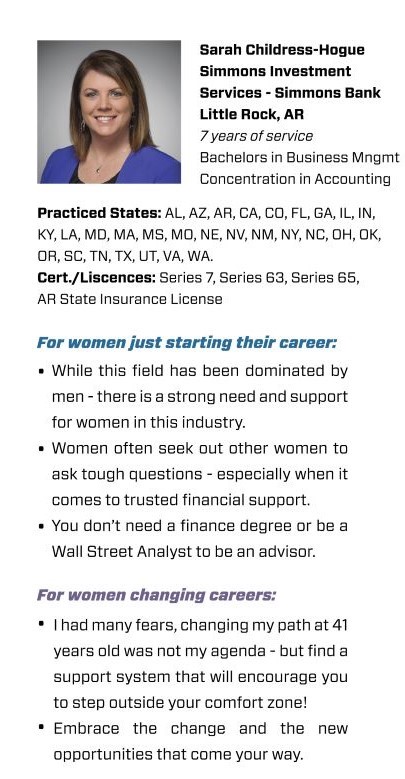

“I don’t have the right degree”. “I need to be a Wall Street expert”. And the list goes on. While this field has historically been dominated by men, there is a strong need and strong support for women in this industry. Historically, women have been on the sidelines when it comes to financial planning. Many are now nearing retirement or coming into control of assets for which their husbands have previously been responsible. With that can come fear and the desire for trusted financial support. The majority will seek out other women to ask those tough questions. We see clients through many phases of life, whether it is planning for a child’s education, transitioning into retirement, long-term care planning, inheriting assets or starting a business. You don’t need a finance degree or be a Wall Street analyst. I would encourage anyone considering this field to give me a call, I would love to tell my story of how this became my “path” and answer any questions!

What advice would you give a woman considering the financial advising profession with some experience who is looking to change careers?

When I started in 2013 as an unlicensed assistant, financial advising was a profession I had not imagined for myself. I started with personal and professional experience but still held misconceptions about what financial advising was. Within 9 months, I became licensed to enhance the support I could provide to our financial advisors and their clients. Eventually, I moved onto a supervisory role as the manager of sales and operations. Supporting our firms’ financial advisors and client associates was my destined career path, or so I thought! Roughly a year and a half ago, I was provided a unique opportunity to pair with another financial advisor (also female) seeking to retire. I had many fears, changing my “path” at 41 years old was not on my agenda! I had a strong support group within my family and my company that encouraged me to step outside my comfort zone. I now manage a substantial book of business with a wonderful client base and have formed many new relationships I would not have otherwise had the opportunity to make. I would encourage anyone considering a change to take those steps outside of their comfort zone and embrace the opportunities.