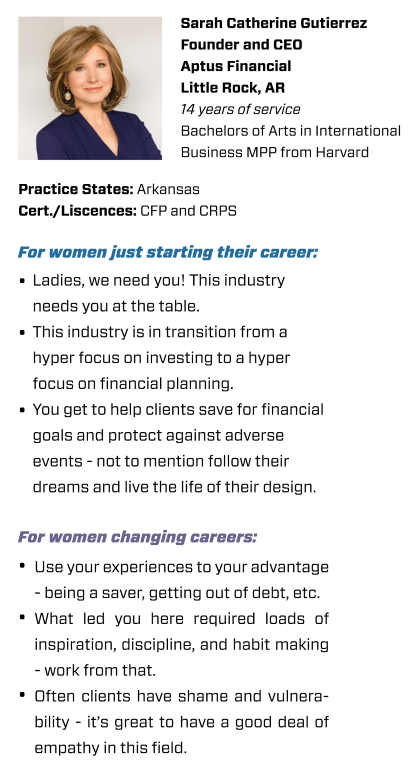

Editors Note: Smart Women Smart Money Magazine wants to highlight industry professionals who excel in their field. Our hope is to connect our readers with professionals who can help them in their financial journey. We also aim to inspire women to consider professions that support financial literacy efforts for individuals and their families. This is the second advisor in the spotlight.

What advice would you give young women just starting their careers who are considering the financial advising profession?

The financial advisory industry needs you at the table. Women often report feelings of intimidation when they see the financial industry, and there are a variety of reasons those feelings that have prevented women from pursuing a financial career. In risk measurements and anecdotally, women feel the most intimidated by investing, but the research actually shows that women outperform men in investing. That very humility and concern leads to a set-it-and-forget-it strategy. Women are less likely to trade on “hot tips.” This explains their outperformance relative to men. So, seriously, ladies, we need you. The financial industry is in transition from a hyper-focus on investing to a hyper-focus on financial planning or helping clients to save for financial goals and protect against adverse events. In other words, we are truly helping people follow their dreams and live the life of their own design. That’s pretty great, right?

What advice would you give a woman considering the financial advising profession with some experience who is looking to change careers?

Life experience can be an incredible benefit for going into a financial advising profession, especially women who have struggled and succeeded to become a saver or get out of credit card debt. Pick one individual financial planning topic. Even if it is laden with jargon, you can do some google searching and within an hour or two probably understand what it means. But becoming a saver? Paying off credit card debt? That is hard stuff that takes often years of experience. It requires loads of inspiration, discipline, habit making. Being able to guide clients on the path to paying down debt and becoming a saver would be a major benefit for a new advisor changing careers, even if they didn’t have formal financial or investment experience. The other advice is for people who have a good deal of empathy to join the field. Sometimes we get clients who feel so much shame and vulnerability, and it is important that they are approached with understanding and compassion, not judgment.