By Samantha Compton

This month, we’re continuing to look at Financial Principle #5: Protect the Income, Grow the Rest, with a closer look at how to estimate your income needs for retirement.

A few times each year, I teach a class on how to simplify retirement planning. Every time I teach the class, I get looks of bewilderment when I tell attendees that before they can begin writing their specific retirement plan, they will first need to know how much net income they will need to cover their retirement expenses. I think the bewilderment comes because the question is one they aren’t confident they can have an answer. Some attendees have heard that they should plan to live on a set percentage (perhaps 80%) of their pre-retirement income. Some attendees have never followed a budget, so they have never really defined or been aware of what they are spending on their monthly obligations. Some attendees assume their budget is determined based on how much they have saved. But what if more is needed? Or, what if less is needed and something better could be done with a portion of the savings to allow for continued growth for future expenses? With all of these pre-conceived ideas, the best approach is to ask, “Is there a better way to do our retirement income planning?” I believe the answer is “YES!”

What I know after ten years of helping people plan for their retirement is this: Nobody that retires lives on a certain amount before retirement and then drastically changes their spending simply because they stop working. The bills and expenses don’t suddenly realize that there has been a significant life change! In other words, your essential monthly costs will remain about the same as you transition to this new season of life. Some things will change (for example, how much spent on healthcare coverage in retirement), but we can usually get a pretty good estimate of how much those things might cost and plan for the needed income.

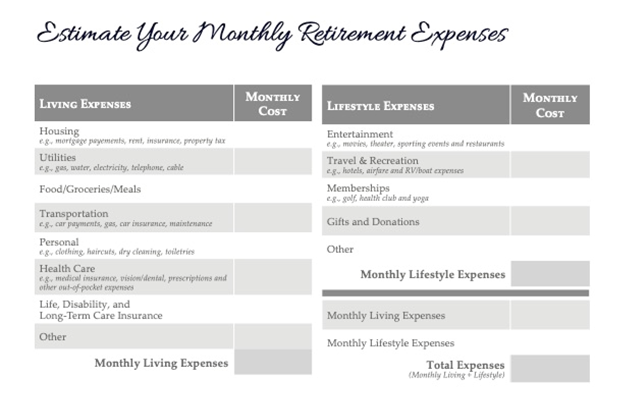

During the class, I have the attendees work through a simple budget worksheet to estimate their fundamental expenditures for their retirement lifestyle. This worksheet is divided into two parts: Living Expenses and Lifestyle Expenses. Living Expenses are the things one could not live without (Shelter, utilities, groceries, etc.). In contrast, Lifestyle Expenses are expenses that may or may not continue through retirement. Many retirees spend more money in their earlier years on things like travel, memberships, etc. but tend to slow down in their later years and may not need those expenses as a permanent part of their budget.

It is important to separate the Living and Lifestyle expenses. Depending on the amount you have saved, you may or may not choose to create a lifetime income that covers both. Many will want to create a set amount of income that will cover their living expenses and then pull from their growth bucket for lifestyle expenses as they occur. This decision is unique to each person or couple and their specific situation.

When you are estimating your income needs for retirement, work with net numbers. (After-tax) If you are concerned about inflation affecting the amount of income you’ll need in retirement, that is valid. However, do not let it complicate or confuse the process when figuring out the amount of income you’ll need. Use today’s dollar amounts to keep it simple. That is your starting point. A good retirement planner can help you address inflation depending on how far away you are from retirement.

Action Step:

Use a basic budgeting form or program to estimate the amount of net income needed in retirement. Base your expenses on what they would cost you today. Remember to be thorough but keep it simple. The budget doesn’t need to be perfect to be a great starting point. Separate your Living expenses from your Lifestyle expenses and know both of those totals.

Next month, we’ll talk about how to estimate your income to know if you’ll have enough to cover the expenses you are anticipating!

Samantha Compton is an SWSM contributor and financial advisor. She is also a Senior Financial Advisor & Women’s Investment Specialist with an SEC Registered Investment Advisor Firm in the Kansas City, MO area. She places a high value on financial education and believes it is essential for creating and sticking to a well-written financial plan!

Disclaimers:

This article is written to provide general information on the subjects covered. It is not, however, intended to provide specific legal or tax advice and cannot be used to avoid tax penalties or to promote, market, or recommend any tax plan or arrangement. Please note that Wise Wealth, LLC and its representatives do not give legal or tax advice. Consult your tax advisor or attorney for advice specific to your circumstances.