By Hon. Kimberly Yee, State Treasurer of Arizona

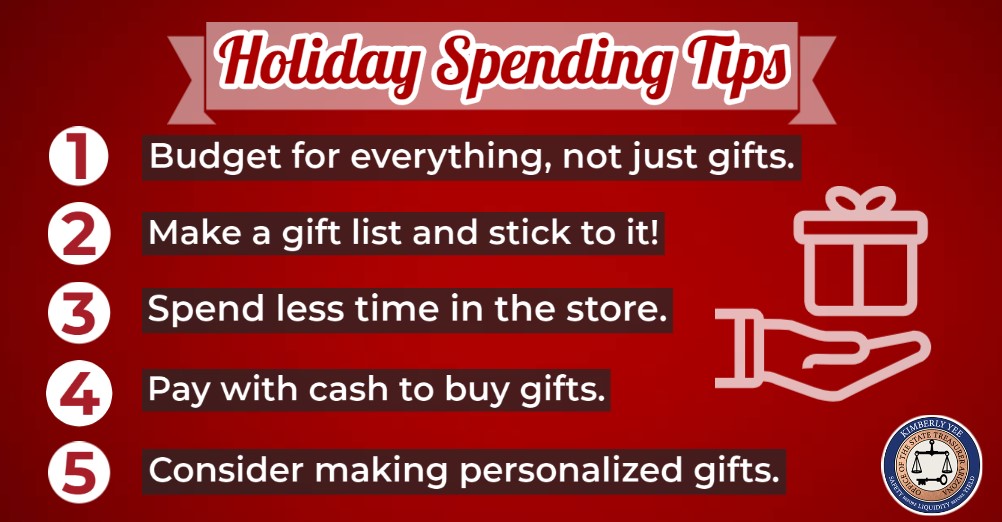

As the Arizona State Treasurer and chairwoman of the state’s first-ever Financial Literacy Task Force, increasing financial awareness is one of my top priorities. By making wise personal finance decisions, Arizonans not only strengthen themselves but also their families, communities and the overall economic health of our state. The holiday season is commonly a time of overspending and breaking personal budgets. According to the National Retail Federation, Americans spent on average $1,047.83 last holiday season, a 4% percent increase from the previous year. Holidays can be a festive time to spend on your loved ones without drowning in debt. Read my 5 practical tips on how to shop smart this holiday season.

1. Budget for everything, not just gifts.

Before you begin any holiday shopping, figure out what your budget is and how much you can afford to spend on gifts and holiday expenses. Write your budget down and keep yourself accountable to exactly how much you want to spend within those limits. Then make a list of everyone you want to give a gift to including family, friends, teachers, and coworkers. Factor in all the costs of shopping like shipping, gas and packaging. Don’t forget to account for other holiday expenses such as decorations, food, holiday-apparel, greeting cards, travel and charitable contributions. By determining how much you’re able to spend from your disposable income, you can feel confident and prepared to begin your holiday shopping.

2. Make a gift list and stick to it!

Before you start shopping, whether it’s online or in-person, create a list of everything you want to purchase. Stores are designed to incentivize you to buy as much as possible, so walk in prepared with a plan and do your best to avoid sales pitches. Avoid window shopping and stay within the aisles of the store for the items on your list to avoid excess purchases. This tip applies to the non-holiday season too. When you enter the store, look for only the items on your gift list. You will be less tempted to overspend and buy items that are not on your list when you have a set budget.

3. Spend less time in the store, so that you purchase less.

Spending more time in a store usually leads to more purchasing and more opportunity to break your budget. Prevent impulse spending by shopping when pressed for time. By researching online before you enter the store, you can compare prices with different stores, take advantage of the best bargains, and maximize your time. When shopping online, which is increasingly more common, set a time limit for how long you will spend on the online store’s website.

4. Pay with cash to buy gifts.

Cash is the best paying option to maintain your holiday budget. When you’re swiping a plastic card, you cannot tangibly see money leaving your pocket. If you hand over $100 in cash, you are more likely to be aware of how much you are spending. Cash has no hidden fees! When shopping online, paying with a credit card is necessary, so make sure you can pay off the full balance. Also, avoid opening new store credit cards that come with hidden fees and incentivize you to spend more in the store. If you’re prone to making frivolous purchases, having a store card may induce you to spend more to try to earn the offered rewards. Also, store cards often have extremely high-interest rates – sometimes up to 23% – which could lead you to quickly racking up interest-related debt. By paying with cash when possible, you will spend your money, not borrowed money.

5. Consider making personalized gifts.

Homemade presents are personal, meaningful treasures to give to your loved ones and a great way to save money while creating something memorable and one of a kind. In the day and age of digital photos, consider compiling an old-fashioned photo album for family members and friends, or bake a batch of Christmas cookies to wrap as gifts. Another idea is giving the gift of time by visiting your far-away family and friends or offering up a free ‘night of babysitting’ card for a busy couple who would love a night out. Personalized gifts are unique, unexpected, and can’t be compared to anything you’d find in a traditional store. The homemade, personalized gift-giving opportunities, mixed in with a bit of creativity, are endless!

By practicing these smart shopping tips, you can start off 2021 without holiday debt! The holiday season should be a time for enjoying family and friends’ company, not worrying about your money.

Editors note: All views, positions, opinion, statements and recommendations expressed in any Smart Women Smart Money (SWSM) print or digital publication should not be construed as an endorsement for, or opposition to, any candidate, potential candidate, political party, or PAC by the State Financial Officers Foundation or Smart Women Smart Money.