By Samantha Compton, SWSM Resident Financial Advisor

This month we’ll be building on the first Principle of Financial Planning that I introduced last month: Financial Security Comes From Having A Plan. You can read last month’s article here.

Something I’ve witnessed over the years is a common trait in those who are successful in and through retirement. Those who are strong financially in their later years began building and exercising their financial muscles early on, beginning with planning for and tracking their income and expenses… aka budgeting.

A written plan includes your goals. One of the first questions I ask when sitting down with a new client (no matter what phase of life they are in) is “How much do you need each month to cover your expenses?”. Unfortunately, only about 20% of people are able to answer this question.

Knowing how much we need each month in order to live is essential knowledge. So, why are so many people unable to answer that question?

Here are 3 common reasons for those who do not have an awareness of their monthly cash flow:

First, they feel a budget will shut down their freedom and restrict them in ways they cannot live with. OR, they are simply afraid of what their spending says about them. Second, they feel that if they can’t do it perfectly, then “why even try at all?” And third, they have more than enough income and simply haven’t “felt” the need to track everything.

Here are four things I’ve learned:

1. Smart Women know where their money goes.

Being the boss of my money, instead of my money dictating my decisions and emotions, is absolutely EMPOWERING! The more I grow in this area, the more confidence I gain in ALL areas of my life.

2. Budgeting doesn’t need to be complex, nor perfect.

Budgeting is making a plan for how you want to spend your money and then recording how you actually spent it. It’s simple math. It’s keeping a list of what comes in and what goes out. It can be updated monthly, weekly, or daily depending on what works for you. It can be old-school, using a spiral notebook. Or, if you enjoy utilizing technology, you can use an online program or an app on your phone. Just don’t get caught up in an “all or nothing” or perfectionistic mindset. It’ll freeze you up. Make it EASY and quick for yourself so you don’t avoid doing it.

3. The best budgeting thrives in a judgment-free zone.

When we see what we spend in certain areas, sometimes our negative self-talk kicks into high gear. We may begin scolding ourselves and using words like “should or shouldn’t”, which can be counter-productive. Just treat your budget like tracking of facts… with no emotion attached. As you begin to see patterns of spending over time, YOU get to decide if that spending is worth it to you. YOU get to decide what you spend your money on and you get to live with the outcome. If you don’t like the outcome, YOU get to decide to do something different!

4. Budgeting builds financial muscles that last a lifetime.

When I sit down with women and couples who are within 5 years of retirement, I can quickly get an idea of who will thrive or struggle on a fixed income. Those who have tracked their cash flow, chosen to live within their means, and become the boss of their money have built strong “financial muscles”. They have learned to say “no” to themselves when necessary but have also learned to empower themselves to say “yes” in financial areas. They do this by simply PLANNING for what they want to spend. In contrast, those who have never developed those muscles, often struggle as they enter into retirement. They consistently spend more than they “thought they would” and it can take years for them to get a handle on that. This can quickly eat up growth resources that were supposed to be used for future income and expenses and is a setup to “outlive” their money.

Whatever your age or phase of life, if your desire is to build strong financial muscles, I’ll remind you what I sometimes have to remind clients, “The past is in the past. Focus only on what you can do differently now and in the future!”

Remember that, just as in the gym, strong muscles aren’t built overnight or even in just a few weeks. They are built with consistent, repetitive exercise which means doing it even when we don’t feel like it.

Action Steps:

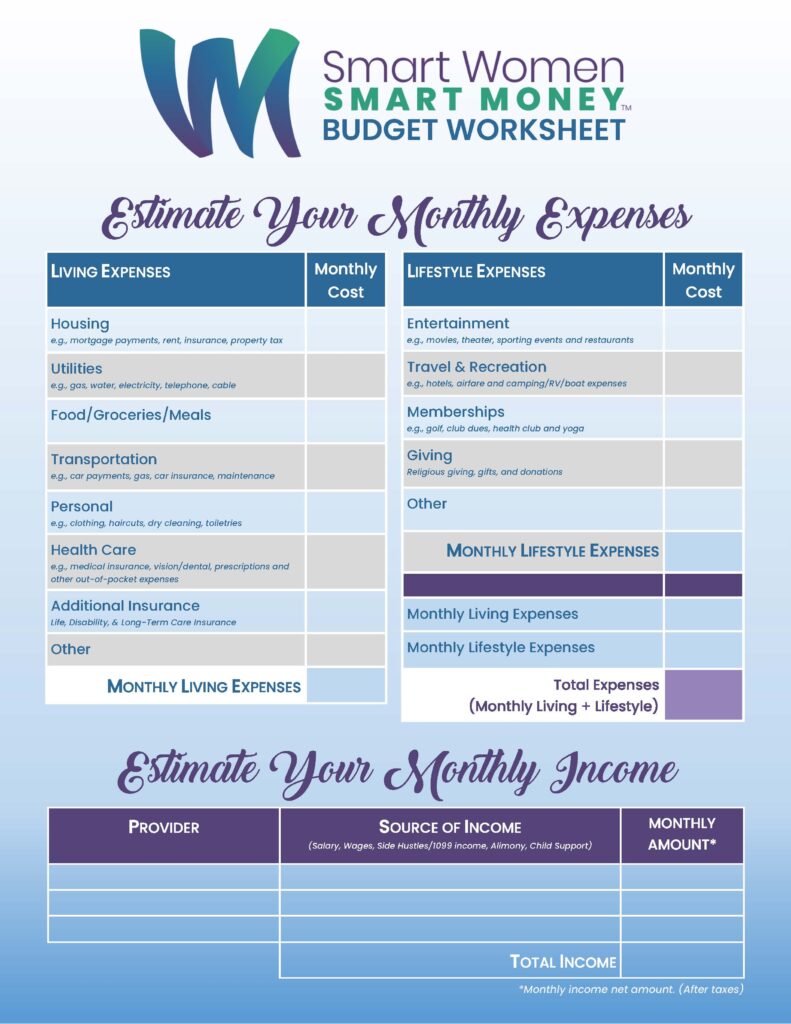

Just Start. Begin with a basic budgeting form either on paper or online and start tracking. CLICK HERE to use SWSM’s printable budget worksheet. Start with simple, basic categories. Give yourself 6 months of consistent tracking. Keep it a judgement-free zone. Just track the facts and a pattern will emerge. If you want to either strengthen or change that pattern, YOU have all the power to do it!

Next month, we’ll look at strategies for getting from where you are to where you want to be! Being intentional in how and where you save for the future is part of a solid long-term financial plan.

Samantha Compton is a SWSM contributor and financial advisor. She is also a Senior Financial Advisor & Women’s Investment Specialist with an SEC Registered Investment Advisor Firm in the Kansas City, MO area. She places a high value on financial education and believes it is essential for creating and sticking-to a well-written financial plan!

Disclaimers:

This article is written to provide general information on the subjects covered. It is not, however, intended to provide specific legal or tax advice and cannot be used to avoid tax penalties or to promote, market, or recommend any tax plan or arrangement. Please note that Wise Wealth, LLC and its representatives do not give legal or tax advice. Consult your tax advisor or attorney for advice specific to your circumstances.