By Sarah Wall

It’s October 12, and I’m celebrating National Savings Day.

Some of you may be asking (even if you won’t admit it out loud!), “But why would I celebrate a day about saving money? Doesn’t ‘celebrating’ usually involve spending money?”

If that’s you, I’d like to share with you what an enormous blessing financial savings have been in my own life – and how they’ve given me plenty of reason to celebrate. While my own money-saving habits have been useful, it’s the habits of someone else that laid the foundation for so much of my financial freedom: my dad.

Making Savings a Priority

When I was a baby, my dad was early in his mechanical engineering career. In fact, he graduated from Old Dominion University just five months before I was born! Not only had he just started a full-time career, he and my mom were also in the middle of renovating their historic home in Portsmouth, Virginia. Needless to say, with all that and a new baby, I’m sure they could have found plenty of ways to put their money to good use!

Still, my parents wanted to make sure that I was set up for success. Before I could even walk, he began investing in the Virginia 529 plan for my future college education. There was no limit to how much he could invest annually and no federal tax on the contributions or withdrawals, as long as they were used for educational expenses. He could even deduct up to $4,000 off his tax forms for contributions he made to the 529 plan.

A Small Amount Can Make a Big Difference

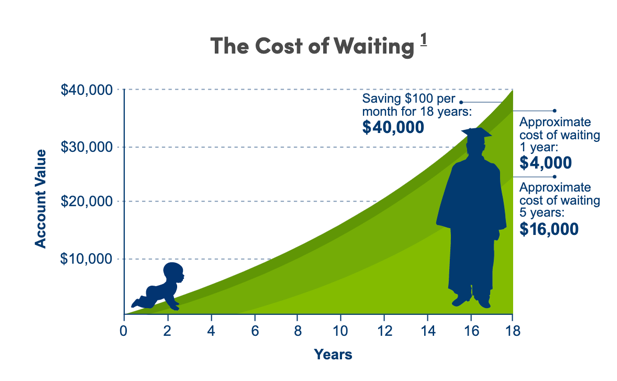

What’s especially important to know about 529 plans is this: Your contributions don’t have to be much to make a big difference. Because whatever you contribute is invested in the stock market, the savings continually compound. Think of it this way: investing $100/month in a regular savings account (pretend there’s no interest for a moment) would only yield $1,200 in a year. After 18 years, you’d have $21,600. That’s not bad, but unfortunately, at most universities these days, that will barely cover a quarter of educational costs for an undergraduate degree.

Investing that $100 every month in a 529 plan means the money continually grows with the stock market. Instead of having $21,600 after 18 years, you would have somewhere around $40,000. Now that might get you a little further down the road towards graduation! Source: https://www.virginia529.com/learn/basics/

What did all this mean for me? It means that I graduated with my bachelor’s degree from The College of William & Mary without a penny in student loan debt.

In fairness, I held up my end of the bargain: my dad asked that I enroll in an in-state public university since Virginia has plenty of great options. I also took enough summer credits to have just one class online during my senior year, which saved my family a lot in tuition and living costs.

But what strikes me about my 529 plan is that my dad decided to start it, with my mom’s enthusiastic support, in the very beginning. They had a new baby, a new career, and a new house to renovate, but alongside all their other priorities, they made the decision to consistently put aside a portion of their income for my education. That decision set me up for financial freedom even when I was a new graduate, something not all of my peers can say. Most importantly, my dad also instilled in me a respect for saving and avoidance of debt that have benefitted me long after graduation.

Not everyone has that story. I deeply admire those of you who responsibly paid or continue to pay your student loans that were such an important investment in your future. But for those of you who have children, or would like to have children one day, I encourage you to think about setting up a 529 plan for their future education. It doesn’t take much: just $100 every month can make a huge difference towards the increasingly hefty price tag on a college degree.

On this National Savings Day, I’m thanking my dad for the gift of the 529 plan that gave me financial freedom. I know that on some National Savings Day in the future, my children will be able to thank me, too.

Sarah Wall is the newest contributing writer for Smart Women Smart Money Magazine. For questions or comments email staff@smartwomensmartmoney.com.